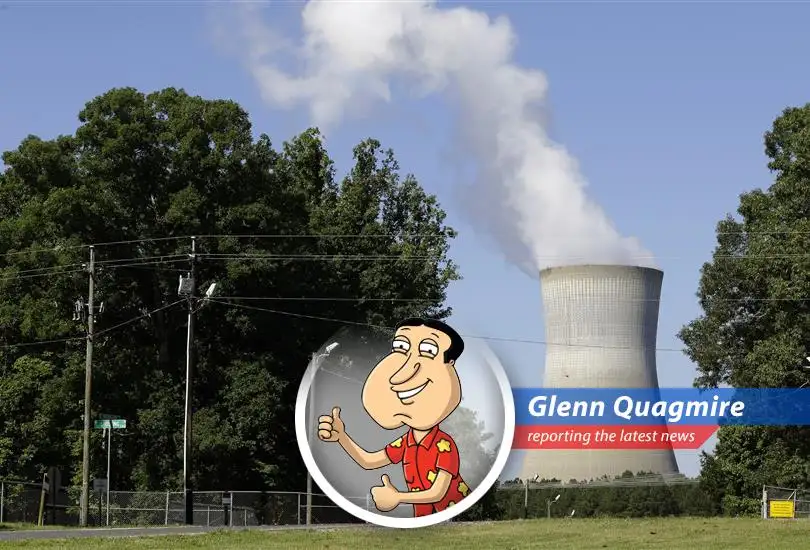

Nuclear Power Meets Data Centers

The U.S. nuclear fleet is becoming a hot topic as a potential power source for artificial intelligence and data centers. With 31 gigawatts of incremental power demand expected through 2030 companies are eyeing the existing 95 nuclear reactors.

Cash Flow Galore

"Giggity giggity goo!" The Inflation Reduction Act is offering a juicy production tax credit of $15 per megawatt hour for nuclear power generation from 2024 to 2032. Regulated utilities like Duke Energy and Southern Company are set to benefit from this financial boost.

Earnings on the Rise

Analysts predict modest earnings growth for regulated utilities with nuclear assets thanks to the tax credit windfall. Duke Energy and Southern Company are expected to see cash flow benefits that could improve their long term financial outlook.

Stocks on the Move

Duke Energy and Southern Company stocks have been on the rise with Duke operating 9 gigawatts of nuclear capacity and Southern Company running 5.4 gigawatts. Investors are keeping a close eye on these companies as the nuclear power trend gains momentum.

Comments

- No comments yet. Become a member to post your comments.