- Morgan Stanley predicts Cipher Mining and TeraWulf stocks could more than double, driven by their transition to AI-focused data centers.

- The shift is fueled by a shortage of AI compute power and increasing demand from hyperscalers seeking "time to power" solutions.

- Bitcoin's downturn presents an opportunity for miners to repurpose infrastructure, though challenges like credit constraints and cost overruns remain.

- The transformation of Bitcoin mining warehouses into data centers could introduce cost overruns.

A Disturbance in the Force Bitcoin's Retreat

The crypto market, like Alderaan, has seen better days. Bitcoin, once a symbol of decentralized power, has retreated from its peak, leaving many investors feeling as helpless as a Jawa in a sandstorm. But from the ashes of crypto winter, a new hope emerges. Morgan Stanley, an institution whose pronouncements carry the weight of a Star Destroyer, sees a path to redemption for two unlikely heroes: Cipher Mining and TeraWulf. Their transformation is complete.

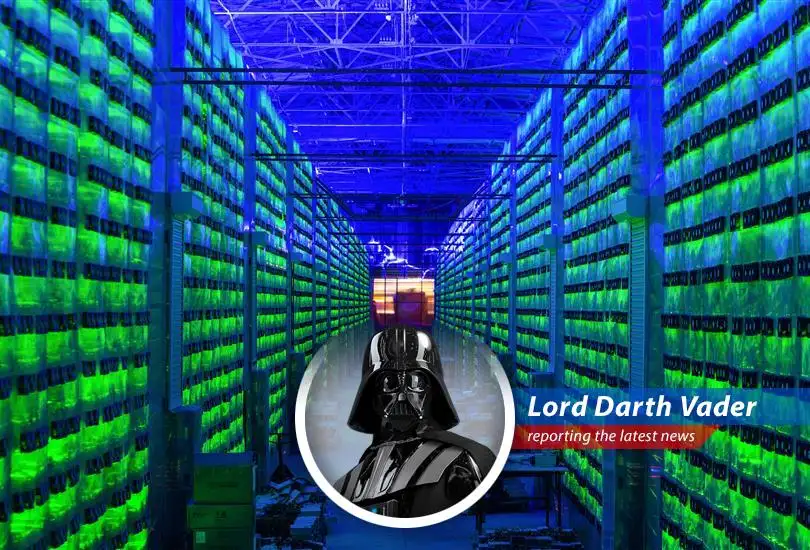

From Mining Rigs to AI Empires The Great Shift

These companies, once dedicated to the extraction of digital gold, are now setting their sights on the far more lucrative realm of artificial intelligence. Their strategy is simple, yet elegant: repurpose their existing infrastructure into data centers optimized for AI computation. This is where the Force truly awakens. Morgan Stanley projects a potential doubling of their stock value, a feat that would make even a Wookiee cheer. This transformation highlights a new narrative, you can read more about similar shifts and adaptions in Starbucks Brews a Comeback Story: Is the Shine Really Back, where businesses re-invent themselves to thrive in changing markets.

The Hyperscalers' Plea A Galaxy of Demand

The key to this potential lies in the insatiable appetite of hyperscalers – the tech giants who control the digital galaxy. These entities require vast amounts of computational power to fuel their AI ambitions, and they are willing to pay a premium for what Morgan Stanley calls "time to power" solutions. Cipher and TeraWulf, with their repurposed mining facilities, are uniquely positioned to meet this demand. Their expertise is a pathway to many abilities some consider to be unnatural.

Power Struggles The Bottleneck is Real

Traditional data center developers face a significant obstacle: access to power. The demand for electricity is outstripping supply, creating bottlenecks that threaten to stifle AI innovation. Morgan Stanley's analysts believe that even if these developers secured all available power from former Bitcoin companies, they would still fall short. This scarcity gives Cipher and TeraWulf a distinct advantage, making them valuable allies in the hyperscalers' quest for computational dominance.

The Dark Side of the Force Risks Remain

Of course, no plan is without its weaknesses. As I told Luke, "Search your feelings." Morgan Stanley acknowledges potential pitfalls, including credit challenges, scaling limitations in large language models, and the risk of cost overruns during the conversion process. These are real concerns that must be addressed with the precision of a lightsaber duel. Failure is not an option.

A Calculated Gamble A New Hope

Despite the risks, the potential rewards are too significant to ignore. Cipher and TeraWulf are betting that their transition to AI-focused data centers will unlock a new era of growth and profitability. Only time will tell if they succeed. But remember, "It is our choices, Harry, that show what we truly are, far more than our abilities". For now, the Force is strong with these two companies, and their journey is one worth watching. "Perhaps I can find new disciples..."

Maggiehall

Is this sustainable long term?