- Asian markets, particularly South Korea and Australia, experienced significant declines amid a tech-led sell-off.

- Japan's Nikkei 225 defied the trend, posting gains driven by auto sector performance and leadership changes.

- U.S. tech giants faced pressure, impacting global markets, and raising concerns about AI spending and memory shortages.

- Commodities saw volatility, with silver prices rebounding after a sharp crash, reflecting broader economic uncertainties.

Market Mayhem: Another Day, Another Battlefield

Heard the news. Markets crashing in Asia. Korea taking a beating, Australia too. Makes a man think about control. About who's pulling the strings. Back in 'Nam, it was Charlie. Now it's algorithms and silicon. But the fight's the same. Survival. Adaptation. You push back, or you end up a statistic. The Kospi dropping 5% - that's a gut punch. But you gotta get up. Always get up.

The Japanese Anomaly: Rising Sun, Rising Stocks

Japan's Nikkei bucked the trend. Upward trajectory, defying gravity. Toyota doing well, CEO stepping down. New leadership, new direction. Sometimes, you gotta change to stay alive. Like changing your magazine when you're pinned down. Important to consider the factors involved, such as those that may come to light when assesing U.S.-India Trade Deal A Saiyan-Sized Agreement or Just Hot Air when assessing long-term economic stability. It seems like the rest of the world should be paying attention to Japan. They seem to be knowing the rules of the game, and playing them.

Big Tech's Big Spender: AI Arms Race

Alphabet throwing down $185 billion on AI. That's war money. Different kind of war, but a war nonetheless. It's about dominance. Control of the future. Makes you wonder what they're really building. What weapons they're developing. "To survive a war, you gotta become war.", right? But this ain't your daddy's war. More sophisticated and subtle, but every bit as destructive when things go south.

The Memory Game: Qualcomm's Shortage Scare

Qualcomm feeling the pinch, memory shortage hitting their forecast. Supply lines, just like in a jungle. Cut them off, and you cripple your enemy. This ain't about bullets and bombs. It's about chips and circuits. But the principle's the same. Resource control. Whoever controls the resources, controls the game. This is the new battlefield.

Silver Lining or Fool's Gold? Commodity Chaos

Silver prices crashing, then bouncing back. Volatility. Uncertainty. Like walking through a minefield. One wrong step, and you're blown to kingdom come. Gotta watch your footing. Gotta be careful. "Nothing is over" until you control these resources. They dictate the terms. Don't ever underestimate their importance.

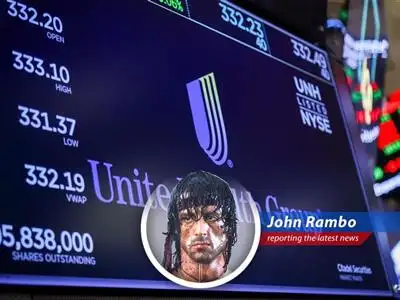

Echoes from Wall Street: A Warning Shot

Wall Street took a beating. Dow down, S&P down, Nasdaq down even more. Tech took the biggest hit. Remember what I said about control? When you lose control, you lose everything. These guys need to stay vigilant. "Live for nothing, or die for something." This ain't over. Not by a long shot. The market is full of unpredictable events.

Comments

- No comments yet. Become a member to post your comments.