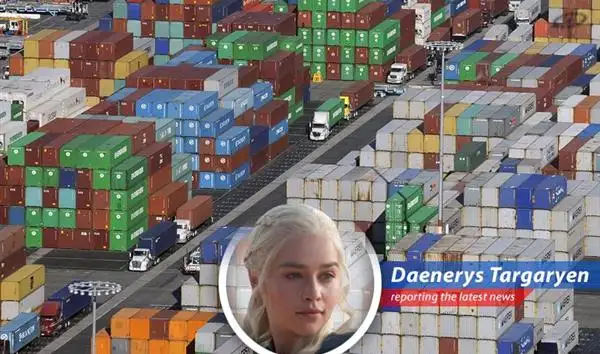

- The U.S. trade deficit increased significantly in December, defying expectations and raising concerns about trade policy effectiveness.

- Despite tariff implementations, the annual trade deficit remained substantial, signaling persistent challenges in balancing imports and exports.

- Major trading partners like the EU, China, and Mexico contribute significantly to the overall U.S. trade deficit.

- Increased exports and imports both played a role in the year's trade dynamics, reflecting ongoing global economic interactions.

The Big December Deficit Surprise

Oh, hello there. Carrie Bradshaw here, and I couldn't help but wonder... is the U.S. trade deficit the new Mr. Big? Just when you think you've figured it out, it throws you for a loop. December's numbers came in, and let's just say they were more shocking than finding out Aidan was still into furniture design. The deficit ballooned to $70.3 billion, a far cry from what the experts predicted. It felt like walking into a sample sale and finding out everything is full price. What's a girl to do?

Tariffs and Tantrums Did They Even Work

Remember when Trump tried to fix everything with tariffs? It was like trying to solve a relationship problem with a new pair of Manolos; it looks good on the surface, but does it really address the underlying issues? He slapped tariffs left and right, hoping to level the playing field. But instead, it felt like we were all just running around in stilettos on a baseball diamond. Did it work? Well, the annual deficit was still a whopping $901.5 billion. It's like putting a Band-Aid on a broken heart. Speaking of economic woes, Cisco's Earnings Impress But Stock Dips Giggety. It's a reminder that nothing is ever quite as straightforward as it seems. It makes one wonder about the efficacy of such policies.

Who's to Blame A Global Affair

So, who's the culprit? It turns out, it's a global affair. The biggest deficits were with the European Union, China, and Mexico. It's like trying to decide who's the worst boyfriend; they all have their flaws. The EU, with a $218.8 billion deficit, is like that sophisticated European guy who always leaves you wondering if he's really into you. China, at $202.1 billion, is the complicated, on-again, off-again relationship. And Mexico, at $196.9 billion, is the one you keep going back to, even though you know it's not right. It's a tangled web of international relations, and I'm just trying to navigate it in my Jimmy Choos.

Exporting and Importing A Balancing Act

Here's the thing both exports and imports increased. It's like trying to lose weight but also wanting to eat cake. Exports rose to $3.43 trillion, which is fantastic. It's like finally getting that book deal you've always dreamed of. But imports also went up, totaling $4.33 trillion. That's like the advance you get for the book, only to realize you have to actually write it. It's a constant balancing act, trying to keep everything in equilibrium. And sometimes, you just need a really good cosmo to make it all seem manageable.

Front-Loading and Fickle Trends

Remember when companies tried to beat the tariffs by front-loading imports? It was like trying to snag the last Birkin bag before the price goes up. Smart in theory, but chaotic in practice. It created a temporary blip, with October showing the lowest monthly deficit in years. But then, reality set in. Trends changed, policies shifted, and the deficit bounced back. It's a reminder that in both fashion and finance, what's hot today might be totally over tomorrow. Stability, darling, is always in style.

What Does It All Mean For Us

So, what does all this mean for us, the fabulous people of New York (and beyond)? Well, it's complicated. It means our economy is intertwined with the rest of the world, and what happens in China affects what happens on Fifth Avenue. It means we need to pay attention to these numbers, even if they're not as exciting as a new pair of Louboutins. Because ultimately, our financial well-being depends on understanding these trends and making informed decisions. And maybe, just maybe, finding a really good investment strategy. After all, as I always say, "I like my money where I can see it hanging in my closet."

Comments

- No comments yet. Become a member to post your comments.