- Restaurant Brands International (RBI) surpasses earnings and revenue expectations, driven by robust international expansion.

- Burger King's international performance shines, offsetting challenges faced by Popeyes in the US and Canada.

- Strategic moves, including a joint venture in China and leadership changes at Popeyes, signal a proactive approach to growth.

- Tim Hortons remains a significant revenue contributor, though slightly below Wall Street's same-store sales expectations.

Earnings Exceed Expectations A Schrute Farms Perspective

As Assistant Regional Manager (and volunteer Sheriff's Deputy), I understand the importance of exceeding expectations. Like a beet farmer anticipating a bountiful harvest, Restaurant Brands International (RBI) has delivered. The numbers don't lie. Adjusted earnings per share hit 96 cents, surpassing the anticipated 95 cents. Revenue soared to $2.47 billion, exceeding the $2.41 billion forecast. This is not just good; it's beet-level good. Bears. Beets. Battlestar Galactica. And profitable restaurants. Very important.

Global Domination The Burger King Empire Expands

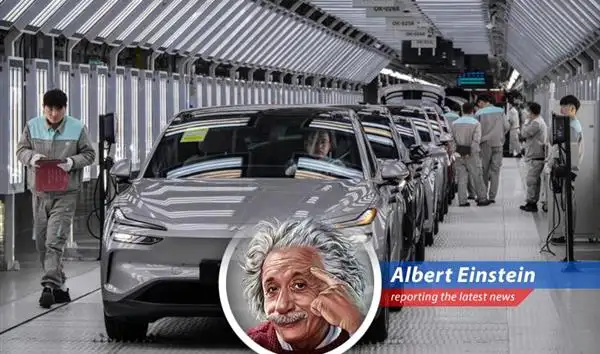

International growth is paramount. As Sun Tzu said in *The Art of War*, "Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt." RBI's strategic expansion, particularly with Burger King, embodies this. Outside the US and Canada, same-store sales surged by 6.1%. Burger King International led the charge, with a 5.8% increase. This is strategic brilliance. Speaking of strategy, have you read my sales strategy? It's called "The Schrute Pyramid of Success" and it's available for a nominal fee. You can also learn more about Cisco Navigates AI Boom Amidst Market Skepticism and technology market and the importance of strategic planning in competitive industries. This move into the Chinese market with the joint venture underscores RBI's global ambitions.

Tim Hortons A Canadian Powerhouse

Tim Hortons, a Canadian institution, continues to be a major player, accounting for 46% of RBI's revenue. While same-store sales growth of 2.9% fell slightly short of the projected 3.8%, it remains a significant contribution. Think of it as the steady, reliable worker – not flashy, but always there, like Mose on the farm. A good, strong number. It's important to have the right beans for the coffee. The right soil for the beets. And the right attitude for success.

Popeyes in Crisis? Leadership Changes Signal Revival

Not all is sunshine and gravy, however. Popeyes same-store sales declined by 4.8%, a steeper drop than anticipated. This is a concerning trend, akin to finding a bear in your beet field. However, RBI is not standing idly by. The appointment of Peter Perdue, a Burger King veteran, to lead the US and Canadian business, along with Matt Rubin as the new CMO, signifies a commitment to revitalization. These are the decisive actions of a responsible leader. The kind of leadership I exhibit daily at Dunder Mifflin.

Investor Day Insights Preparing for Future Growth

The upcoming investor day in Miami on February 26th promises to reveal more strategies for growth. As a volunteer Sheriff's Deputy, I understand the importance of preparation. You must always be ready for anything, whether it's a bear attack or a surprise audit. RBI's proactive approach, coupled with strategic leadership changes, suggests a company poised for future success. I will be watching closely, ensuring they follow proper business practices.

Schrute's Conclusion A Testament to Resilience

In conclusion, Restaurant Brands International demonstrates resilience and strategic acumen. While challenges remain, particularly with Popeyes, the company's global expansion and proactive leadership indicate a strong foundation for future growth. As I always say, "Whenever I'm about to do something, I think, 'Would an idiot do that?' And if they would, I do not do that thing." RBI appears to be following this principle, and that, my friends, is a good thing. Very good.

lynnch

Strategic partnerships are essential for continued global expansion.