- Don't let those shiny dividends distract you from the real goal: total returns.

- Chasing yield can lead you down a rabbit hole of risky investments.

- Focus on your overall goals and risk tolerance, not just income.

- The economy is tougher than it looks, so don't play it too safe.

Dividends? More Like Divide-dends-n't

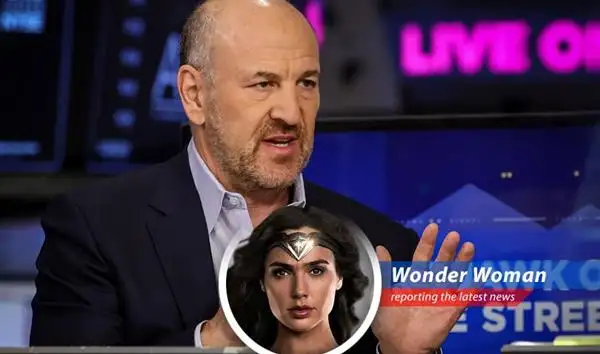

Alright, people, Jinx here, your totally legit financial advisor. So, some boring nerds in suits (you know, the type who wouldn't know fun if it slapped them in the face with a rocket launcher) are saying you shouldn't get all hot and bothered over dividends. Apparently, according to some Kathmere Capital dude named Nick Ryder, focusing on income is for chumps. He's all about 'total return,' whatever that means. Sounds suspiciously like 'total destruction,' which I'm much more familiar with.

Yield Chasing is for Losers... And Fishbones

Ryder, this finance guy, warns against "yield-chasing." Says it can lead you into risky business, like diving into high-yield bonds. That's like trusting Vi to bake you a cake – disaster waiting to happen. Instead, he wants you to think about your goals and risk tolerance. Risk? I laugh in the face of risk. It's what I have for breakfast. But, hey, maybe some of you like playing it safe. And if you are into investments you might be into Dividend Stocks Shine: Capital Group Unveils AI and Healthcare Opportunities, as well.

Economy: Resilient or Just Plain Stubborn?

Apparently, this Ryder guy thinks the economy is "pretty darn resilient." Corporate profitability is up, too. I guess that means more money for bullets and rockets, right? But don't get complacent. Just because things look okay doesn't mean you can't still blow something up. Metaphorically, of course. Or not.

Amplify ETFs: Not Just a Fancy Name

Another brainiac, Christian Magoon from Amplify ETFs, chimes in. He says don't let the distribution number call the shots. It's all about balancing that sweet yield with some long-term, capital-appreciation action. Basically, don't be a one-trick pony. Mix it up. Like mixing gunpowder and glitter – sparkly explosions are the best.

My Take: Embrace the Chaos!

So, what's the Jinx-approved takeaway here? Forget playing it safe. Don't get bogged down in boring dividends. Aim for total chaos... I mean, return. Think big, take risks, and don't be afraid to blow up the system. Figuratively, of course. Unless you have a rocket launcher handy. Then, maybe not so figuratively.

Remember Who's Really in Charge... Of Your Money (Maybe)

Remember, I'm Jinx. I have explosions on my side. While the experts might provide sound financial advice, remember to keep things interesting. After all, "Rules are made to be broken... Like buildings or people".

Comments

- No comments yet. Become a member to post your comments.